AmCham is a 'must-join' organization for any company of scope or international ambition.

Karlis Cerbulis, Senior Vice President of NCH Advisors, Inc.

While it is not unusual with the transition of U.S. Presidential administrations for allies to reaffirm their outstanding commitments, the Trump administration has brought about a very different atmosphere. From the outset, the incoming administration sent very mixed signals and contradictory moves with regards to the future of U.S. foreign policy including publically disparaging the European allies and openly praising Russia.

On the heels of President Trump's visit to NATO Headquarters this past May, it is important to review the relationship that the U.S. still has with Europe. After all, the calls from the U.S. expecting more commitment and spending on defense by its European allies is actually nothing new as the previous administrations of Bush and Obama have pushed for it. But what seems to have finally galvanized the European allies to increase their defense spending is the ongoing Russian-Ukrainian War and the Trump administration's position towards the alliance.

On the heels of President Trump's visit to NATO Headquarters this past May, it is important to review the relationship that the U.S. still has with Europe. After all, the calls from the U.S. expecting more commitment and spending on defense by its European allies is actually nothing new as the previous administrations of Bush and Obama have pushed for it. But what seems to have finally galvanized the European allies to increase their defense spending is the ongoing Russian-Ukrainian War and the Trump administration's position towards the alliance.

Peter B. Doran of CEPA recently remarked, "For decades, Europe has languished in a weird bubble of low defense spending, atrophied fighting capabilities, and indifference to growing threats from neighbors." The illegal annexation of Crimea, the direct support to separatists in eastern Ukraine, the shooting down of flight MH17, and Russia's violations of the Minsk accords have jolted this indifference. The revelations of Russian meddling in the U.S. presidential election highlights the influence campaigns, disinformation, and propaganda that Russia uses to target the Western democratic institutions.

So what does this all mean for the national economies within the European Union? What does it mean for entities such as American Chamber of Commerce in Latvia? The current situation reminds us of the potential for international political conflict to threaten the financial and operational stability of companies. Geopolitical shocks in the post-9/11 world have reminded us of the intersection of business and foreign policy can greatly impact a business' bottom line. The economic growth and modernization of Latvia brought on by European Union membership is underwritten by membership in the NATO Alliance. Despite the rhetoric coming from the White House, the United States remains committed to its European allies and has dedicated the spending to build up the future operational capability to underwrite that economic development.

Geopolitical Risks present in Latvia

The predominate geopolitical risks include the economic impact of the ongoing Russia sanctions, energy issues, and future projects, particularly in transit & logistics, being threatened with the current posturing of military forces in the region. When sanctions were imposed on Russia for the illegal annexation of Crimea and support to separatists in the Donbas, the Baltic States were greatly exposed to risk to their export sector due to the particularly close trade ties to Russia. This came true in the form of Russia's counter sanctions and import ban across various categories of agricultural production including meats, vegetables, and dairy. According to Nordea, "[i]n the first nine months of 2015, export levels to Russia from Latvia, Estonia and Lithuania decreased by 21 %, 38 % and 41 % respectively." Sectors that had been particularly exposed to sanctions risk included the food industry - notably dairy production - as well as logistics & transit and petroleum & natural gas. Across the European Union, agriculture and food exports to Russia fell by 43 percent between August 2014 and July 2015. However, since this initial pain, the economies have adjusted and continue to do so in order to overcome the challenge posed by Russia's counter-sanctions.

In addition, geopolitical concerns are reflected in the ongoing Russia-Ukraine war as energy concerns continue to maintain their position in the European market. The current Nord Stream 2 pipeline project is a flashpoint for the Baltic Sea region as the new pipeline, upon its completion in 2019, will extend from St. Petersburg to Germany under the Baltic Sea. Brussels and Eastern Europe states criticized it for reducing Europe's energy security and even forming a geopolitical threat to Europe. The company already successfully completed the first Nord Stream pipeline in 2011 as part of a broader strategy to diversify from its reliance on the Soviet-built pipeline system that runs through Ukraine and Belarus. The port city of Ventspils and the Ministry of Foreign Affairs have very different positions regarding participation in the project. The port received an offer to participate as a delivery and storage point for construction materials & supplies that could have potentially earned the Latvian government EUR 25 million through transit fees and taxes. The Ministry reported that the project goes against the country's foreign policy principles, which are aimed at cooperation with EU and NATO neighbors in the region and state support of the Nord Stream 2 project would hinder Latvia's credibility in its foreign policy efforts within NATO and the EU.

Even the Rail Baltic project, valued at €3.7 Billion ( Billion) and currently the largest European Union infrastructure project in the Baltic nations, is not immune from geopolitics. Upon completion in 2025, the rail line will replace the Soviet-era 1,520mm gauge to continental Europe's 1,435mm and it will integrate the Baltic capitals as well as Helsinki to the European rail network. This project ultimately represents further integration with Europe and something that has been the focus of Russian attention for some time. In 2013, Russia waged a trade war in order to discourage neighboring countries from new trade deals and association agreements with the European Union. These efforts that specifically focused on Ukraine at the time but involved Lithuania, which had its dairy product exports to Russia banned on the supposed basis of health concerns and hygiene standards. The ability of the Rail Baltic line to connect the annual estimate of 16 million tonnes of freight and 5 million passengers to the European Union is a catalyst for future economic growth that further integrates the Baltics to Europe and away from Russia. This may be the unsurprising reason why during the initial public stakeholder discussions in Latvia in 2015, the project came under pressure from online social media, namely from internet trolls and with posts predominately in Russian language, that sought to influence the public's opinion about the Rail Baltic project. Up to this date, Latvian railroads, as well as Estonian and Lithuanian lines, were only connected with the East. A modern high-speed rail connection to the whole of Europe can be seen as opposed to Russian transit and political interests.

One particular project that is gaining much visibility in business circles is China's Belt and Road Initiative. Increasing China-EU trade through the Trillion infrastructure investment program launched in 2013 is currently exposed in uncertainty as "the current geopolitical uncertainties related to economic sanctions with Russia and international military manoeuvring along its borders may carry enough risk to inhibit private investment." This risk highlights that with ongoing tensions, new East-West infrastructure investments along China's Belt and Road initiative will keep a watchful eye on geopolitical developments. China's interest in being able to peacefully increase trade may provide the means to help motivate a resolution of the Ukrainian crisis and reduction of tensions between NATO & Russia.

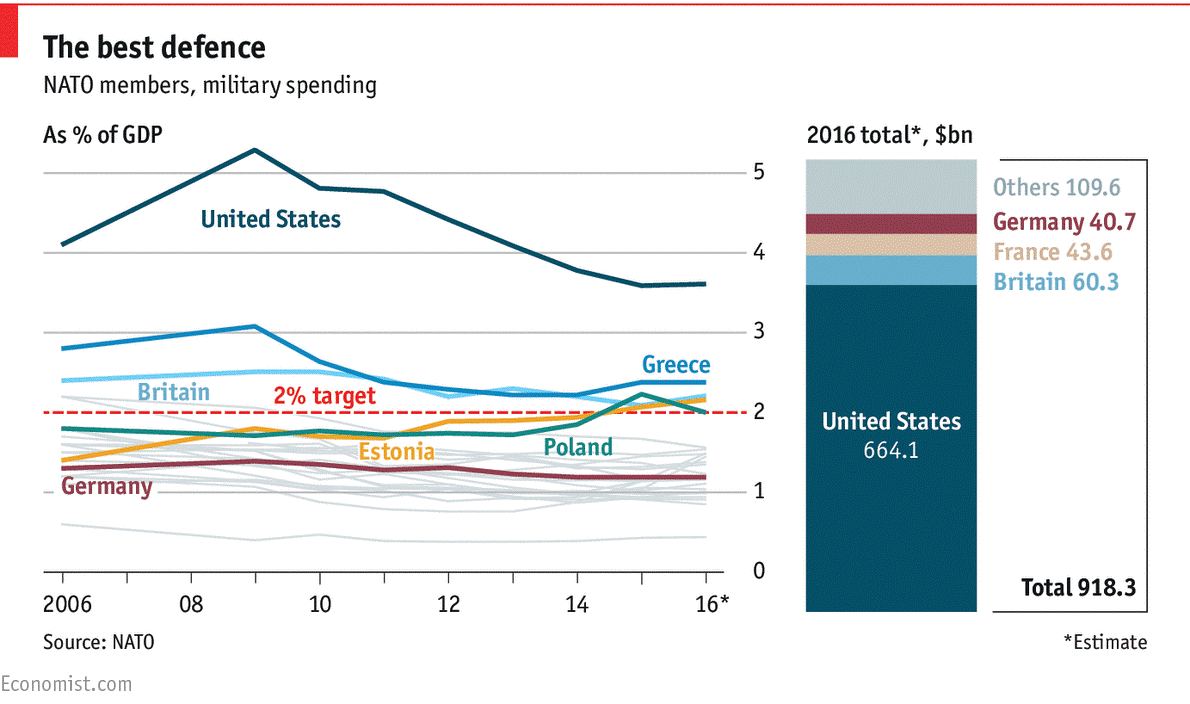

The collective defense of the NATO alliance underwrites the economic performance of the Eurozone economy. The €5.2 Trillion (.1 Trillion) in commercial value of trade and business between the United States and the European Union is underwritten by the security guarantees provided by the collective security and cooperation of the NATO alliance. While the level of bilateral trade between the United States and Latvia is little over 7 million as 2015, the membership of Latvia as part of the European Union and NATO has enabled this Baltic economy's €10.2 Billion in goods & services trade (42% of GDP) and over €4.2 Billion in foreign direct investment (18.8% of GDP). For a small country with a population of little over 2 million residents, these are significant numbers and represent crucial economic interests with the role of stability and security provided by the NATO alliance and partnership with the United States. The investment into military budgets across Europe are justified but as we will see, not all members are contributing the same expenditures towards the collective gains.

NATO Military Spending ; the 2% of GDP Standard

The outgoing Obama administration had called on Europe to increase its defense spending in the wake of the annexation of Crimea by Russia. According to the Latvian government, the country's defense budget is among the fastest growing. It is on track to increase its defense spending by 22% in 2017 to achieve 1.7% of its GDP and is currently set to achieve the 2% GDP standard expected of NATO allies. NATO spending is now on the rise as the Latvian Ministry of Defense budget has increased to €449 million. Currently, Trump administration is dedicating 9.1 billion to the U.S. defense budget for fiscal year 2018. As demonstrated in the graphic above from The Economist , currently only 5 members meet the threshold and defense spending across Europe is expected to rise.

While President Trump has admonished Europe on its defense spending, it is important to keep in mind why the NATO alliance uses the 2% standard as a guide. At the Wales Summit on September 5, 2014, NATO members pledged that they would increase spending to achieve 2% of GDP for defense budgets within 10 years. The 2% pledge has been used as a metric since the 1990's where European defense spending averaged at 2% across the alliance. What needs to be clarified is that this number is a pledge - it is not law and it is not a legally binding commitment as it serves as a guideline for all member states. Despite this distinction, the 2% metric stands out as an easily identifiable standard with which to measure commitment. Until a new metric is established, military spending by NATO allies will continue to be viewed through the lens of GDP expenditure. Therefore, the current spending projected into FY2018 is as metric that the United States is committing to the reassurance of European allies and the deterrence of a resurgent Russia in the wake of the ongoing conflict in Ukraine.

Rebuilding Military Capabilities and Infrastructure

The Warsaw Summit of July 2016 established the protocol for the Enhanced Forward Presence. NATO itself has used the term trip-wire deterrence as the enhanced deployment of forces to the Baltic Republics and Poland. However, the current force projection of 4 multinational battalions and an additional U.S. armored brigade is generally viewed as a "minimal deterrent" or insufficient. The RAND Corporation and a number of other policy experts put forward that if Russia were to invade the Baltic Republics, NATO-US forces positioned there currently would be overrun, resulting in the triggering of Article 5 and the mobilization of NATO militaries in response. Despite this position, we need to bear in mind that the current deployments are the first stage of a longer process in deterring aggression as the United States is not in the business of simply sending forces to go out and die in the event of hostile action.

The deployment of NATO's Enhanced Forward Presence and the multinational battalions is led by the U.S. as the framework nation. The deployment of a U.S. armored brigade in Poland at the Suwalki Gap is further indication of the seriousness of commitment to NATO's eastern allies. While the size of the four multinational battalions is compared to the estimated 13,000 Russian and Belarussian soldiers that will participate in the Zapad 17 exercises in September, what needs to be considered is the long term with regards to NATO and force capability.

As the United States shifts from reassurance to deterrence, it is rebuilding capabilities that have been neglected and degraded from years of focus on the wars in Iraq and Afghanistan. We have to remember that less than 4 years ago, in 2013, the United States pulled out the last remaining M1 Abrams tanks from Germany. For the first time since 1944, there was no American armor on the European continent as the threats were focused on the wars in the Middle East. Incredibly, the illegal annexation of Crimea and the ongoing war in eastern Ukraine has helped to reverse this as the U.S. began rotating armored brigades back into Europe in 2014.

However, in order to have the force level of a brigade with nearly 5,000 soldiers and the full contingent of vehicles and equipment to Latvia, there needs to be infrastructure in place to host this capability. In order to facilitate this military capability, modernized infrastructure is needed. The challenge for NATO and the United States in the Baltic Sea region is the lack of modern military infrastructure. While Latvia is home to numerous former Soviet military facilities - the flotilla facilities in Liepaja, Skrunda, Lielvarde, etc. - much of the infrastructure was not very useful and were in a terrible state when Soviet forces withdrew after the restoration of Baltic independence 25 years ago. The Ministry of Defense has been very aware of the needs for improved infrastructure as the country has been building its forces from the ground up since 1991. Improving military infrastructure is a matter of enabling operational capabilities as well as facilitating the presence of NATO allied militaries in the region in order to deter current Russian aggression.

Upgrading Infrastructure & Building Partner Capacity

The U.S. Army Corps of Engineers (USACE) manages the engineering and construction needs for U.S. Army Europe in support of NATO infrastructure needs. Since 2014, the Europe District of USACE has managed more construction in Eastern and Central Europe this year than it has in the past 40 years combined. In 2017, USACE had 260 projects in design or construction to make improvements to airfields, military quarters, operations centers, training ranges, and support facilities throughout Europe as part of a 0 million subset of the ERI. Up to 6.4 million is dedicated for construction across Poland, the Baltic States, and the Balkans with notable projects including the upgrades to the airbases at Amari (Estonia), Lielvarde (Latvia), and Siauliai (Lithuania).

Currently, as part of the European Reassurance Initiative, the United States is on track to spend .8 billion in FY2018, up nearly .4 billion from 2017. The investment is geared towards enhancing U.S. Army Europe's deterrence posture, improve the readiness and responsiveness of forces towards aggression. The focus areas for the ERI are the increased presence of U.S. forces in Europe, enabling joint exercises and training, prepositioning of equipment, building the capacity of NATO partners, and improving infrastructure. In facilitating the transition from assurance to more permanent deterrence, the capabilities of NATO allied militaries need to be developed.

However, due to the nature of the NATO alliance, member militaries cannot simply rely on the stronger allies. Therefore, what is helping Latvia achieve its commitment to the 2% pledge is the dedication of budget funding to upgrade its infrastructure that will reap future dividends in the operational capabilities of the armed forces. The government approved €110 million for military construction for the period of 2016-2018 and that figure is set to increase. Modernization of the Adaži barracks and training grounds as well as additional transportation infrastructure to facilitate heavy freight capacity will enable the Latvian military not only of the capacity to host joint exercises with NATO forces but an increased level of operational capability for future security.

Looking Ahead

As with any commitment of labor and capital that comes with investment, it is proper and wise to assess the landscape within the business environment in order to distill the prospects of future business activity and returns on those investments. Despite the geopolitical risks facing Latvia and the other Baltic states of Estonia and Lithuania - economic impacts from the sanctions regimes, energy issues, and threats to future projects - it appears that business leaders have taken these into account. Every year the Global CEO Survey intends to explore how global trends impact the business environment and how CEOs view future risks to their businesses. The survey covered companies in the major industries which included retail and wholesale, banking and finance, construction, processing, IT and telecommunications, health, and transport.

The latest Global CEO Survey by PWC revealed an interesting insight. While CEOs from all three Baltic countries shared concern about geopolitical risks, Latvian bosses expressed more concern about the unsettled business environment which included the increasing tax burden (85%), bribery and corruption (75%), and the lack of trust in business (56%). In addition to these concerns, these same individuals polled that they priorities that they are focusing on include working with the national government to build an internationally competitive tax system (87%), fighting the shadow economy (66%), and having a skilled and adaptable workforce (52%).

The fact that these business leaders expressed more concern regarding issues within the Latvian economy over the concern for geopolitical risks may be indicative that the collective security of NATO has allayed the concerns of conflict for the time being. While businesses do indeed focus rightly on the immediate risks to their bottom lines, they are natural in looking ahead to future trends to ensure the sustainability and long-term strategies for their businesses. However, it is not to say that the risk of conflict or hybrid warfare in the Baltic Sea region do not register with the business community as the ongoing conflict in eastern Ukraine presents a current lens through which to view risks.

In Conclusion

The geopolitical situation in Latvia is one that any investor and business leader needs to keep in mind when conducting business here. Although the threat of armed conflict is highly visible with the saber-rattling by Russia, the fact that CEOs in the Baltic capitals are more concerned about the future labor demographics and business environment is a sign that the collective security of NATO has allayed the some concerns of conflict for the time being.

Despite the verbal criticisms coming from Washington D.C., the United States has concretely and objectively demonstrated its commitment to its European allies through increased funding for the European Reassurance Initiative and increasing the operational capabilities of its NATO partners. The increase in defense budgets in the United States and in Europe mark a long-term commitment to deterrence of aggression in the region. The boost in funding for the Baltic countries to build capacity - demonstrated by the U.S. Army Corps of Engineers - is a critically needed step to address the collective vulnerabilities on NATO's Eastern Flank.

The shared values of the Trans-Atlantic relationship between Europe and the United States - free enterprise, market-based economies, and democratic governance - are underwritten by the commitment to collective security. While U.S. Presidents have previously pressed their European counterparts to commit to increased defense spending - rightly so in some cases - the commitment of the United States to the collective defense of the NATO Alliance cannot be in doubt when the current trend is being formed and cemented in place.

Dainis Butners is an individual member of AmCham Latvia and President of the European Business Association of the McDonough School of Business at Georgetown University. This article is the last in a series ‘An American in Riga - the View from Washington'. Prior to this article, the author engaged about the positive factors of the Latvian business climate as well as the negative aspects and challenges facing investors making market entry into the country.

AmCham provides S3 a great opportunity to connect with business community.

Agne Stojakove, Market Vice President, Country Manager Strategic, Staffing Solutions International